Monetizing idle gold in Indian households

Project Type

Professional project at Rupeek Fintech Pvt Ltd

My Role

UX Researcher

Methods

Concept testing, semi-structured interviews, A/B testing

Deliverables

Research report

Tools

Figma, Google sheets, Google Meet

How I researched user acceptance of a gold-backed investment scheme, taking it from concept to pilot launch

01

Context

Gold is an asset that can be foreseen as a potential investment. The gold investment scheme allows people (referred to as investor) with idle gold, kept at home/lockers to gain returns out of it. This investment would be in partnership with a gold loan customer (referred to as borrower), who would be benefited with a lower rate of interest on their loan.

02

The Problem

The gold investment scheme was a new concept that involved some risks depending on the fluctuating market value of gold. The objective was to test the user acceptance of this concept with target users.

03

Objective

To understand whether potential investors are ready to use their stored gold for an investment, while obliging to the risks associated with it

Identify conditions under which risks would be acceptable

Gauge the minimum acceptable interest rate for the investment

04

Hypotheses

Some hypotheses were formulated to test the investment scheme concept:

Value proposition

Potential investors have idle gold with them and are looking for ways to earn returns on it.

Gold is bought and stored thinking it will come handy in hard times.

Trust

Investors will have some issues in trusting a new product, new process and a new company.

They might be ready to invest if borrower is known.

Risk

People have an emotional attatchment with their ornaments and hence, it becomes harder to part with gold for an investment.

05

Method

Concept testing with a dipstick qualitative study

Sample size: 30

Segments covered:

NTGL- Never Taken a Gold Loan

LIGHT- Credit against gold is less than 30% of over all credit taken so far

HEAVY- Credit against gold is more than 30% of over all credit taken so far

06

Structure of research

Demographics

Do users have an understanding of investments associated with risks, intent if any?

Any past investments, what kind?

What kind of risks are acceptable?Are they comfortable in lending? Risk appetite in P2P lending?

Experience with lending money/ gold?

Trust parameters to lendUnderstanding user’s exposure to gold loans and their past experience

How many gold loans taken in the past?

Do they have a fair knowledge of gold loans?Concept feedback

Are risks acceptable?

Is the interest rate an attraction?

What can build trust?

07

Insights

Product features

The interest earned through the investment is benchmarked with fixed deposits.

There is an expectation of higher interest rate.

Users would need a flexibility to take out their gold whenever required without a lock in period.

Assurity of gold is required in cases of uncontrollable disasters.

Risk apprehensions

There is a concern of gold price dropping during a higher tenure of the investment scheme.

Users would prefer a short term tenure as gold price fluctuation is lesser.

Other means of paying up the liability would be preferred like interest being withdrawn, instead auctioning gold.

Borrower details is not a concern.

The company is expected to take responsibility of verifying borrower’s background.

08

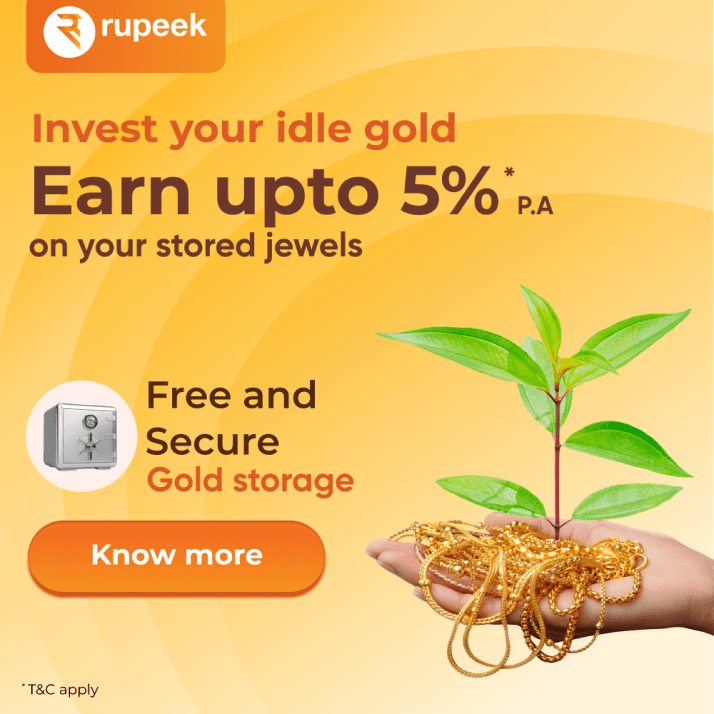

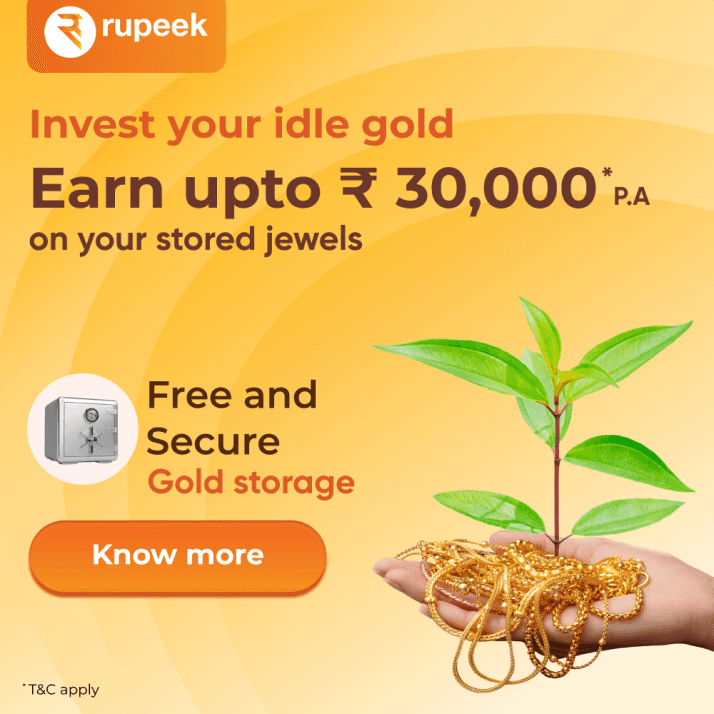

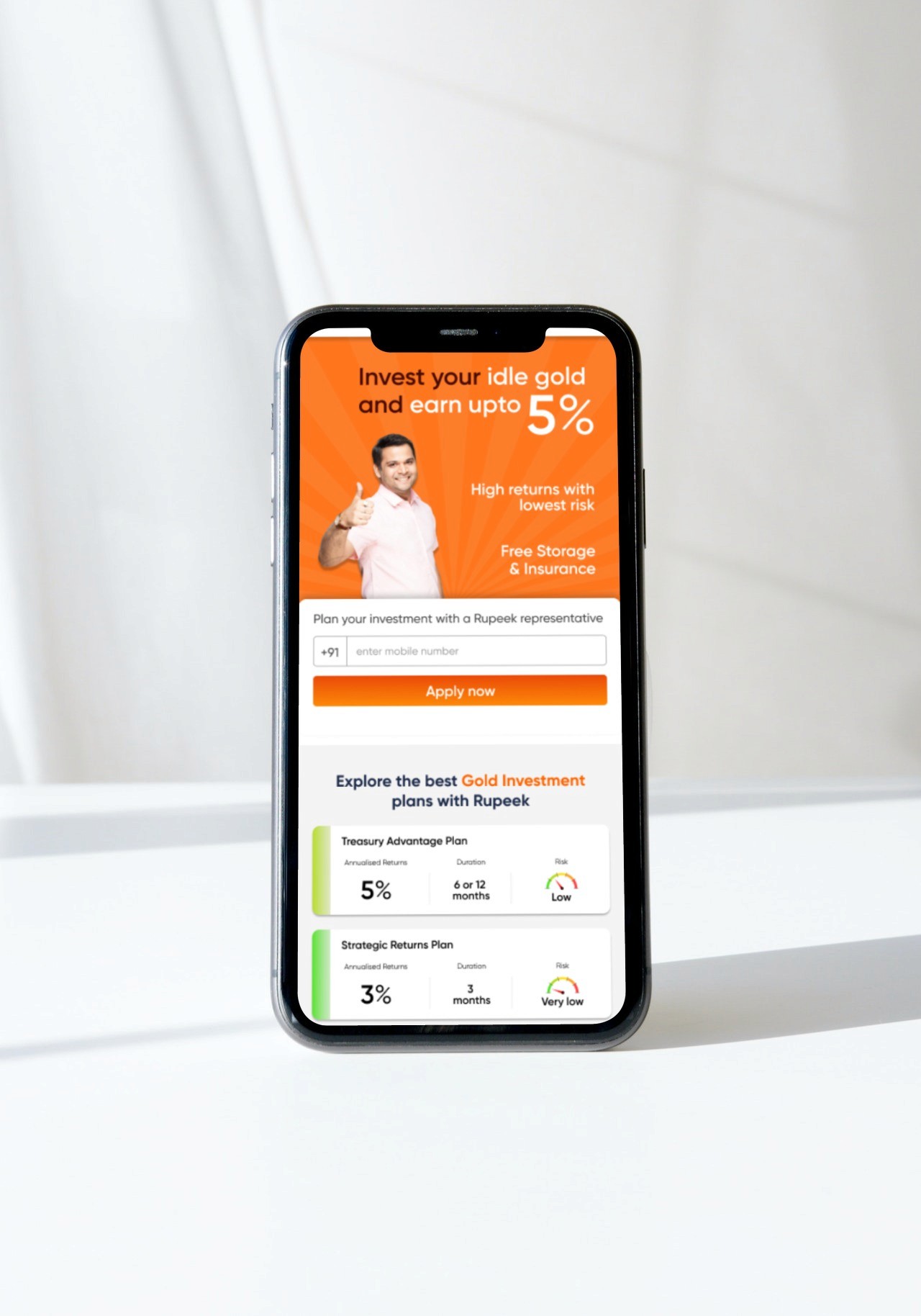

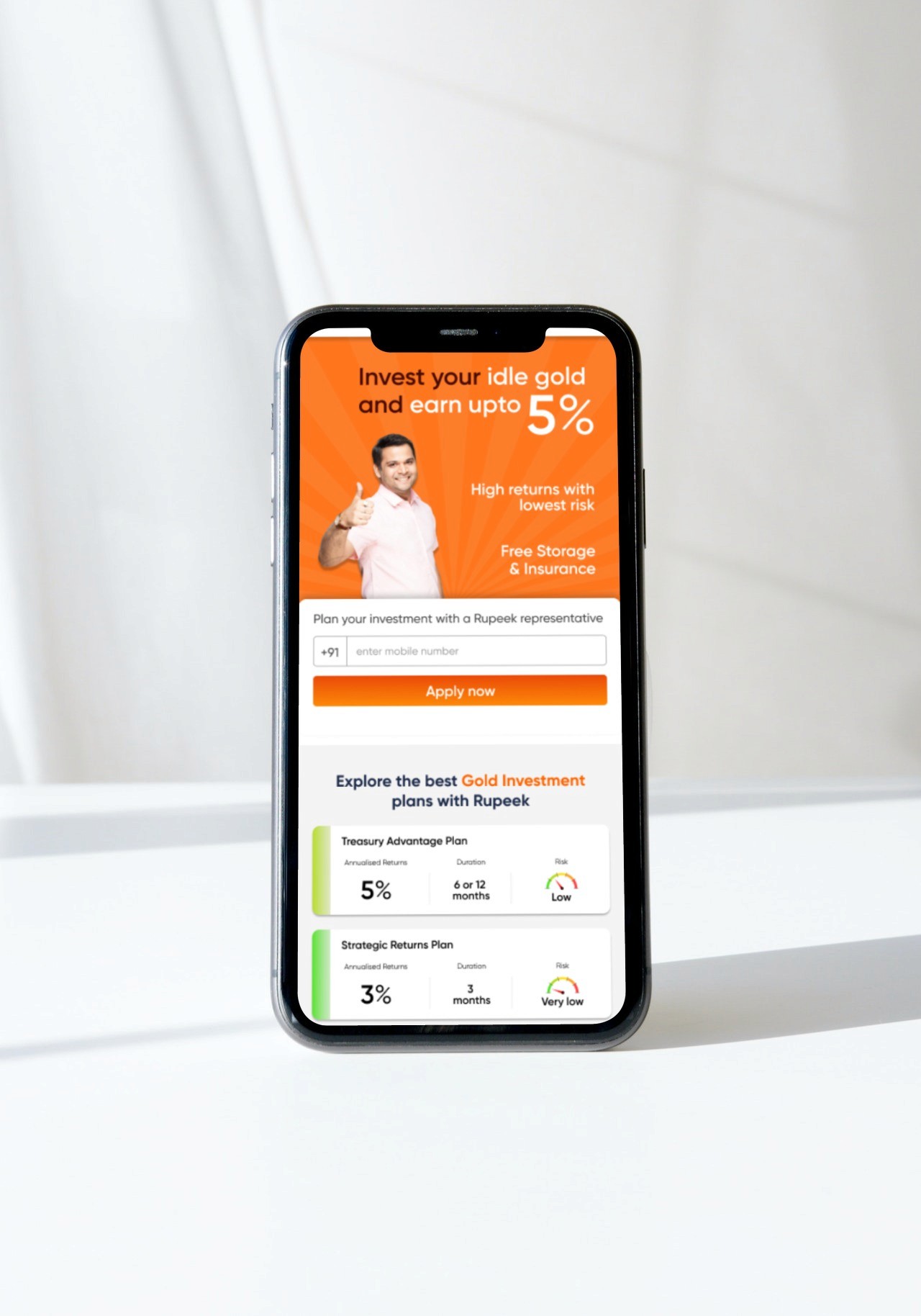

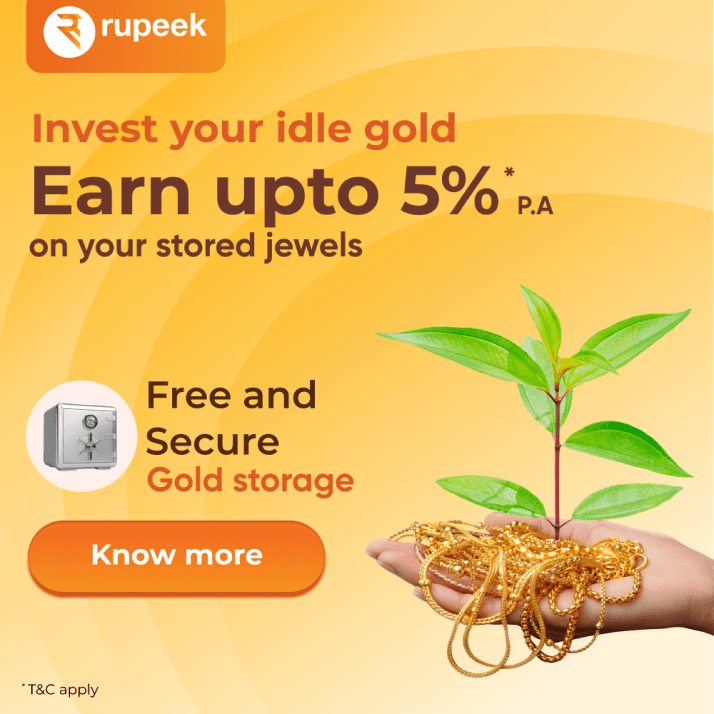

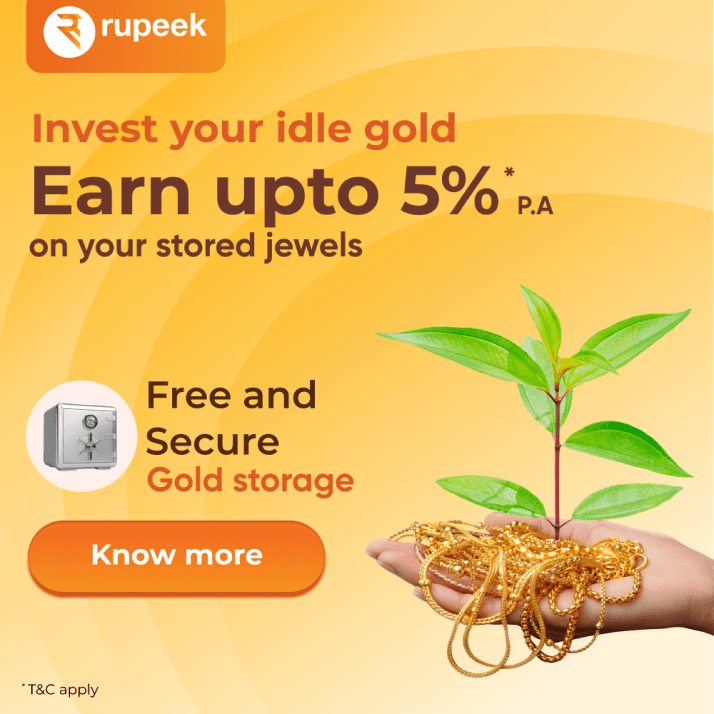

Concept testing with larger audience

Method:

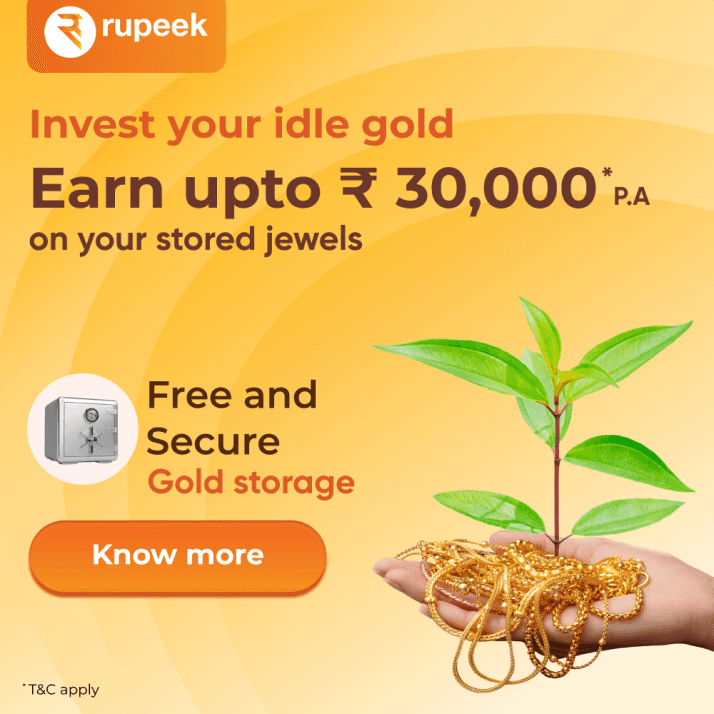

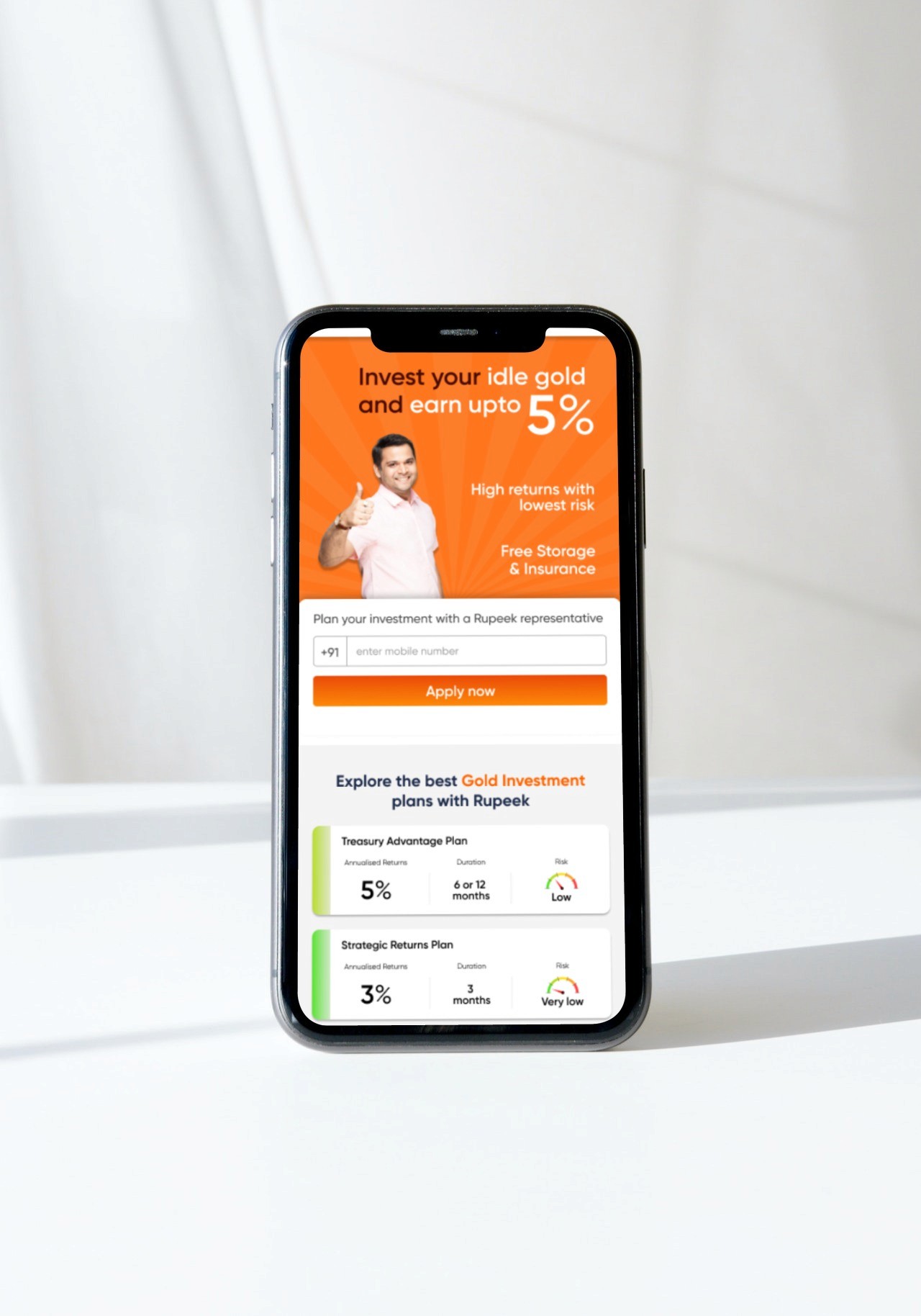

Facebook Advertisement A/B testing

Semi structured interviews with leads generated.

I created 2 Facebook posts anchoring:

Potential of gold lying idle at homes.

The interest/ interest amount earned from the investment.

Free locker service

Emphasis on interest rate

Emphasis on interest amount

Findings:

The creative with ‘interest amount’ generated more leads than the one with ‘interest rate’.

Value proposition

‘Idle gold’ resonates well with users.

Family plays a major role in decision making, especially women being asset holders.

There is lack of transparency when the complete product offering is pitched.

Safety

Storage of gold in private vaults is a concern. Bank vaults are preferred.

09

Outcome

The product, anchored on "value on idle gold" and pitched with higher transparency about product offerings and risk was directed towards a pilot launch.

Next Project

SWARNA

©

Swarna Pandu

2024

How I researched user acceptance of a gold-backed investment scheme, taking it from concept to pilot launch

Monetizing idle gold in Indian households

Project Type

Professional project at Rupeek Fintech Pvt Ltd

My Role

UX Researcher

Methods

Concept testing, semi-structured interviews, A/B testing

Deliverables

Research report

Tools

Figma, Google sheets, Google Meet

01

Context

Gold is an asset that can be foreseen as a potential investment. The gold investment scheme allows people (referred to as investor) with idle gold, kept at home/lockers to gain returns out of it. This investment would be in partnership with a gold loan customer (referred to as borrower), who would be benefited with a lower rate of interest on their loan.

02

The Problem

The gold investment scheme was a new concept that involved some risks depending on the fluctuating market value of gold. The objective was to test the user acceptance of this concept with target users.

03

Objective

To understand whether potential investors are ready to use their stored gold for an investment, while obliging to the risks associated with it

Identify conditions under which risks would be acceptable

Gauge the minimum acceptable interest rate for the investment

04

Hypotheses

Some hypotheses were formulated to test the investment scheme concept:

Value proposition

Potential investors have idle gold with them and are looking for ways to earn returns on it.

Gold is bought and stored thinking it will come handy in hard times.

Trust

Investors will have some issues in trusting a new product, new process and a new company.

They might be ready to invest if borrower is known.

Risk

People have an emotional attatchment with their ornaments and hence, it becomes harder to part with gold for an investment.

05

Method

Concept testing with a dipstick qualitative study

Sample size: 30

Segments covered:

NTGL- Never Taken a Gold Loan

LIGHT- Credit against gold is less than 30% of over all credit taken so far

HEAVY- Credit against gold is more than 30% of over all credit taken so far

06

Structure of research

Demographics

Do users have an understanding of investments associated with risks, intent if any?

Any past investments, what kind?

What kind of risks are acceptable?Are they comfortable in lending? Risk appetite in P2P lending?

Experience with lending money/ gold?

Trust parameters to lendUnderstanding user’s exposure to gold loans and their past experience

How many gold loans taken in the past?

Do they have a fair knowledge of gold loans?Concept feedback

Are risks acceptable?

Is the interest rate an attraction?

What can build trust?

07

Insights

Product features

The interest earned through the investment is benchmarked with fixed deposits.

There is an expectation of higher interest rate.

Users would need a flexibility to take out their gold whenever required without a lock in period.

Assurity of gold is required in cases of uncontrollable disasters.

Risk apprehensions

There is a concern of gold price dropping during a higher tenure of the investment scheme.

Users would prefer a short term tenure as gold price fluctuation is lesser.

Other means of paying up the liability would be preferred like interest being withdrawn, instead auctioning gold.

Borrower details is not a concern.

The company is expected to take responsibility of verifying borrower’s background.

08

Concept testing with larger audience

Method:

Facebook Advertisement A/B testing

Semi structured interviews with leads generated.

I created 2 Facebook posts anchoring:

Potential of gold lying idle at homes.

The interest/ interest amount earned from the investment.

Free locker service

Emphasis on interest rate

Emphasis on interest amount

Findings:

The creative with ‘interest amount’ generated more leads than the one with ‘interest rate’.

Value proposition

‘Idle gold’ resonates well with users.

Family plays a major role in decision making, especially women being asset holders.

There is lack of transparency when the complete product offering is pitched.

Safety

Storage of gold in private vaults is a concern. Bank vaults are preferred.

09

Outcome

The product, anchored on "value on idle gold" and pitched with higher transparency about product offerings and risk was directed towards a pilot launch.

SWARNA

©

Swarna Pandu

2024

SWARNA

©

Swarna Pandu

2024

Monetizing idle gold in Indian households

How I researched user acceptance of a gold-backed investment scheme, taking it from concept to pilot launch

Project Type

Professional project at Rupeek Fintech Pvt Ltd

My Role

UX Researcher

Methods

Concept testing, semi-structured interviews, A/B testing

Deliverables

Research report

Tools

Figma, Google sheets, Google Meet

01

Context

Gold is an asset that can be foreseen as a potential investment. The gold investment scheme allows people (referred to as investor) with idle gold, kept at home/lockers to gain returns out of it. This investment would be in partnership with a gold loan customer (referred to as borrower), who would be benefited with a lower rate of interest on their loan.

02

The Problem

The gold investment scheme was a new concept that involved some risks depending on the fluctuating market value of gold. The objective was to test the user acceptance of this concept with target users.

03

Objective

To understand whether potential investors are ready to use their stored gold for an investment, while obliging to the risks associated with it

Identify conditions under which risks would be acceptable

Gauge the minimum acceptable interest rate for the investment

04

Hypotheses

Some hypotheses were formulated to test the investment scheme concept:

Value proposition

Potential investors have idle gold with them and are looking for ways to earn returns on it.

Gold is bought and stored thinking it will come handy in hard times.

Trust

Investors will have some issues in trusting a new product, new process and a new company.

They might be ready to invest if borrower is known.

Risk

People have an emotional attatchment with their ornaments and hence, it becomes harder to part with gold for an investment.

05

Method

Concept testing with a dipstick qualitative study

Sample size: 30

Segments covered:

NTGL- Never Taken a Gold Loan

LIGHT- Credit against gold is less than 30% of over all credit taken so far

HEAVY- Credit against gold is more than 30% of over all credit taken so far

06

Structure of research

Demographics

Do users have an understanding of investments associated with risks, intent if any?

Any past investments, what kind?

What kind of risks are acceptable?Are they comfortable in lending? Risk appetite in P2P lending?

Experience with lending money/ gold?

Trust parameters to lendUnderstanding user’s exposure to gold loans and their past experience

How many gold loans taken in the past?

Do they have a fair knowledge of gold loans?Concept feedback

Are risks acceptable?

Is the interest rate an attraction?

What can build trust?

07

Insights

Product features

The interest earned through the investment is benchmarked with fixed deposits.

There is an expectation of higher interest rate.

Users would need a flexibility to take out their gold whenever required without a lock in period.

Assurity of gold is required in cases of uncontrollable disasters.

Risk apprehensions

There is a concern of gold price dropping during a higher tenure of the investment scheme.

Users would prefer a short term tenure as gold price fluctuation is lesser.

Other means of paying up the liability would be preferred like interest being withdrawn, instead auctioning gold.

Borrower details is not a concern.

The company is expected to take responsibility of verifying borrower’s background.

08

Concept testing with larger audience

Method:

Facebook Advertisement A/B testing

Semi structured interviews with leads generated.

I created 2 Facebook posts anchoring:

Potential of gold lying idle at homes.

The interest/ interest amount earned from the investment.

Free locker service

Emphasis on interest rate

Emphasis on interest amount

Findings:

The creative with ‘interest amount’ generated more leads than the one with ‘interest rate’.

Value proposition

‘Idle gold’ resonates well with users.

Family plays a major role in decision making, especially women being asset holders.

There is lack of transparency when the complete product offering is pitched.

Safety

Storage of gold in private vaults is a concern. Bank vaults are preferred.

09

Outcome

The product, anchored on "value on idle gold" and pitched with higher transparency about product offerings and risk was directed towards a pilot launch.